Approaching retirement? How to get your pension in shape first

Five options to consider to help boost your potential retirement income.

Check out below all the articles and updates from Kellands.

Five options to consider to help boost your potential retirement income.

We look at the changes to the tax rules at the start of the new tax year and how to make sure your savings and investments are as tax efficient as possible by using all your available allowances and exemptions.

Our latest monthly investment update for April 2024 examines how the global investment markets, economy, and commodities are performing.

Chancellor Jeremy Hunt unveils a Spring Budget with major tax cuts and economic reforms ahead of the upcoming general election.

Our latest monthly investment update for March 2024 examines how the global investment markets, economy, and commodities are performing.

Individuals now need significantly more for a comfortable retirement due to rising living costs and family support expectations.

Our latest monthly investment update for February 2024 examines how the global investment markets, economy, and commodities are performing.

British savers hold £380.9 billion in low-interest accounts, missing out on higher returns.

Our latest monthly investment update for January 2024 examines how the global investment markets, economy, and commodities are performing.

Cash or other financial gifts might be more welcome than ever this Christmas. Here’s some things you need to know.

Our latest monthly investment update for December 2023 examines how the global investment markets, economy, and commodities are performing.

Our latest monthly investment update for November 2023 examines how the global investment markets, economy, and commodities are performing.

Starting estate planning early and implementing it in stages is desirable.

Our latest monthly investment update for October 2023 examines how the global investment markets, economy, and commodities are performing.

Our latest monthly investment update for September 2023 examines how the global investment markets, economy, and commodities are performing.

New research highlights many have a lack of confidence in their retirement prospects.

Our latest monthly investment update for August 2023 examines how the global investment markets, economy, and commodities are performing.

A few ideas to help you increase your chances of a comfortable retirement.

Our latest monthly investment update for July 2023 examines how the global investment markets, economy, and commodities are performing.

Recent research study highlights a significant gap in the money skills of many youngsters.

Our latest monthly investment update for June 2023 examines how the global investment markets, economy, and commodities are performing.

Why the golden rule of investing is even more pertinent in times of uncertainty and volatility.

What to take into account before deciding whether to put money into a pension or an ISA.

Our latest monthly investment update for May 2023 examines how the global investment markets, economy, and commodities are performing.

Asset allocation is a fundamental concept in investment management that helps investors manage their risk while maximising their returns.

Ready to retire, but worried about your savings running out? Read on for a few tips.

Pension pots have always had a role to play in inheritance tax planning but the scrapping of the pensions lifetime allowance means you could now potentially leave large sums completely free of inheritance tax.

Rising inflation and costs mean the amount of money you need to enjoy later life has risen significantly.

In his first Budget as Chancellor, Jeremy Hunt has announced several measures to re-engage those who have left the workforce and encourage business investment.

Our latest monthly investment update for March 2023 looks at how the global investment markets, economy, and commodities are performing.

With the end of the tax year fast approaching, there may still be time to review your tax and financial affairs to make sure you have optimised all your tax allowances and tax planning opportunities. So here’s a few of things to look at before the start of the new tax year on 6 April 2023.

Our latest monthly investment update for February 2023 looks at how the global investment markets, economy, and commodities are performing.

New research has highlighted the value of financial advice for couples.

Our latest monthly investment update for January 2023 looks at how the global investment markets, economy, and commodities are performing.

A quick update on our fundraising for Children in Need 2022

Our latest monthly investment update for December 2022 looks at how the global investment markets, economy, and commodities are performing.

Our latest monthly investment update for November 2022 looks at how the global investment markets, economy, and commodities are performing.

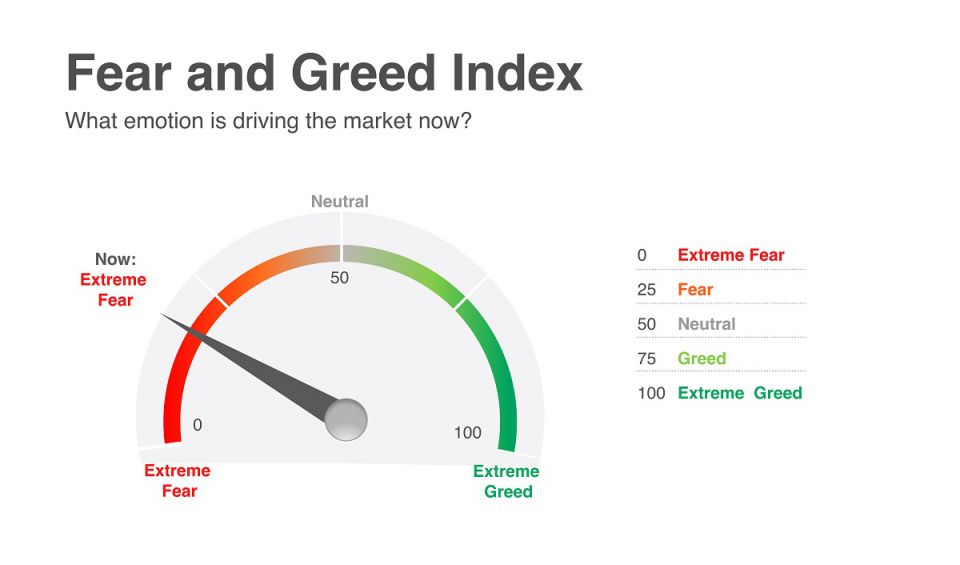

A look at market sentiment in the current environment.

Our latest monthly investment update for October 2022 looks at how the global investment markets, economy, and commodities are performing.

In commemoration of Queen Elizabeth, Queen of the United Kingdom and other Commonwealth realms

Our latest monthly investment update for September 2022 looks at how the global investment markets, economy, and commodities are performing.

Our latest monthly investment update for August 2022 looks at how the global investment markets, economy, and commodities are performing.

Despite rising inflation and the cost-of-living crisis, why you should think twice before dipping into your pension to help out your finances.

Why investors and those planning for retirement need to keep calm and take a long-term view.

Our latest monthly investment update for June 2022 looks at how the global investment markets, economy, and commodities are performing.

With an ageing population, an increasing retirement age and less certainty in what to expect from your pensions, it could be a good time to review what you want from your later life.

Our latest monthly investment update for May 2022 looks at how the global investment markets, economy, and commodities are performing.

Only a quarter of pension savers using a workplace pension believe their current retirement saving rate will not be sufficient for later life.

Our latest monthly investment update for April 2022 looks at how the global investment markets, economy, and commodities are performing.

As another extraordinary financial year comes to a close, it’s more important than ever to make good use of your annual pension allowances. Giving your pension savings a boost and assessing where you stand will give you peace of mind that you are on track to enjoying the retirement you are planning for.

Our latest monthly investment update for March 2022 looks at how the global investment markets, economy, and commodities are performing.

The Russian invasion of Ukraine last week has sparked more uncertainty and volatility in the financial markets

Since the pension freedoms were introduced back in 2015, many retirement investors have opted for income drawdown as part of their retirement income strategy. This can make sense for many, but there are risks involved.

Our latest monthly investment update for February 2022 looks at how the global investment markets, economy, and commodities are performing.

The pandemic saw more people start investing whilst others invested more through the enforced savings brought about by lockdown.

Our latest monthly investment update for January 2022 looks at how the global investment markets, economy, and commodities are performing.

Our latest monthly investment update for December 2021 looks at how the global investment markets, economy, and commodities are performing.

According to new research, more than half of UK adults say the Covid-19 pandemic has affected their retirement plans.

Our latest monthly investment update for November 2021 looks at how the global investment markets, economy, and commodities are performing.

The latest study from the Pensions and Lifetime Savings Association (PLSA) provides a guide to what income you may need

Many bereaved families are missing out on significant inheritance tax rebates

Our latest monthly investment update for October 2021 looks at how the global investment markets, economy, and commodities are performing.

A look at how to make the most of your pension pots and other investments to generate a decent retirement income.

Our latest monthly investment update for September 2021 looks at how the global investment markets, economy, and commodities are performing.

Latest statistics show a 4% increase in tax take with almost a third more families affected

Our latest monthly investment update for August 2021 looks at how the global investment markets, economy, and commodities are performing.

Price inflation in the UK is still rising, with the official rate up to 2.5% in the past year.

Our latest monthly investment update for July 2021 looks at how the global investment markets, economy, and commodities are performing.

An alternative way of looking at your financial affairs, providing you with food for thought.

A spate of recent surveys shows both how people have responded to pensions throughout the pandemic and their general lack of understanding and engagement.

Our latest monthly investment update for June 2021 looks at how the global investment markets, economy, and commodities are performing.

Whilst investors are increasingly prioritising socially responsible investments, fund managers are getting in on the act too.

Our latest monthly investment update for May 2021 looks at how the global investment markets, economy, and commodities are performing.

The pension lifetime allowance (LTA) has been around for 15 years, but the possibility of a potential 55% tax charge on ‘excess’ pension savings still causes confusion and anxiety for many.

Today is the start of the new tax year, so this could be the best time to take advantage of one of the tax breaks available to you, by opening a Stocks and Shares ISA.

In our latest monthly investment update for April 2021, we look at how the global investment markets, economy, and commodities are performing.

Aaron Pitt, Chartered Financial Planner at Kellands Bristol, takes a look at this perennial issue.

Matt Hodges, one of our Chartered Financial Planners, explains why there’s more to financial planning than just the financials.

Today is International Women’s Day, a day which celebrates the social, economic, cultural and political achievements of women from around the world. It is also an opportunity to look into the gender investing gap and what can be done to help encourage women to invest more and take control of their finances.

Here’s a quick summary of just some of the salient points for savers and investors as the Chancellor attempted to perform a balancing act.

In our latest monthly investment update for March 2021, we take a look at how the global investment markets, economy and commodities are performing.

Whilst many investors are tempted to time the market, copious research studies show that it is time in the market that counts.

A new set of pension legislation has received Royal Assent to become an Act of Parliament.

In our latest monthly investment update for February 2021, we take a look at how the global investment markets, economy and commodities are performing.

As we start a New Year it is unusual to be thinking about a year-end. However, the tax year is coming to a close in only a few weeks.

Lockdown 3.0 means we are all having to spend more time at home, so why not use some of your downtime to put your basic ‘wealth planning’ house in order?

After the unprecedented events of 2020, it is quite likely that your perfectly diversified portfolio of a year ago may now need rebalancing.

Could this have been one of the sharpest but also one of the shortest bear markets on record?

In our latest monthly investment update for January 2021, we take a look at how the global investment markets, economy and commodities are performing.

In our latest monthly investment update for December 2020, we take a look at how the global investment markets, economy and commodities are performing.

The latest official figures offer some reasons to be cheerful about the state of recovery in the UK economy.

Pensions have become a focal point for many as the coronavirus pandemic has forced retirees to re-evaluate their pension options. Some with Defined Benefit pensions may be tempted to transfer them, but is this the right thing to do?

In our latest monthly investment update for October 2020, we take a look at how the global investment markets, economy and commodities are performing.

The government has announced that the minimum pension age will rise from 55 to 57 by 2028 to coincide with the rise in the state pension age to 67.

Has the Covid-19 pandemic and its associated economic fallout changed your attitudes towards investing?

In our latest monthly investment update for September 2020, we take a look at how the global investment markets, economy and commodities are performing.

In our latest monthly investment update for August 2020, we take a look at how the global investment markets, economy and commodities are performing.

Behavioural biases play a significant role in our decision-making as investors.

A scourge of the retail financial services profession are promotions for unregulated investments.

In our latest monthly investment update for July 2020, we take a look at how the global investment markets, economy and commodities are performing.

When it comes to equity release, there are a lot of myths.

In our latest monthly investment update for June 2020, we take a look at how the global investment markets, economy and commodities are performing.

A surge in 55th birthdays and the fifth anniversary of pension freedoms were unintentionally timed this year to coincide with the current coronavirus pandemic.

In our latest monthly investment update for May 2020, we take a look at how the global investment markets, economy and commodities are performing.

During these challenging financial times, to what extent have pension savers been raiding pension pots?

The economic impact of the coronavirus pandemic on the UK is likely to be significant, but recovery may be quicker than in other countries.

In our latest monthly investment update for April 2020, we take a look at how the global investment markets, economy and commodities are performing.

In our latest monthly investment update for March 2020, we take a look at how the global investment markets, economy and commodities are performing.

As an investor, how should you be responding to the impact that the coronavirus is having on global stock markets?

The increasing popularity of equity release as part of the retirement planning mix was demonstrated in 2017, which saw new records set in the equity release market.

With an ageing population and a prolonged period of rising property prices, it’s no surprise to see equity release growing in popularity.

In our latest investment update for February 2020, we take a look at how the global investment markets, economy and commodities are performing.

It’s no secret that the nature of retirement is changing. What used to be considered by many as a quiet, relaxing time in life, is increasingly becoming a period of greater activity.

As we start the New Year, we take a look at how the global investment markets, economy and commodities are performing.

In our latest monthly investment update for December 2019, we take a look at how the global investment markets, economy and commodities are performing.

If you reach retirement age with insufficient savings, you face several choices.

In our latest monthly investment update for November 2019, we take a look at how the global investment markets, economy and commodities are performing.

What’s your retirement savings target?

If you are in your 50s or 60s, your thoughts are probably turning towards retirement. When should you retire? How much money do you need?

The past decade has seen a big increase in ethical investing, although in overall terms, it is still a relatively niche market. In the middle of Good Money Week, which aims to let investors know about the range of ethical and sustainable financial options, we take a brief look at some of the statistics and issues.

When do you plan to retire? The date you select for your retirement can have a significant impact on the value of your pension pot.

In our latest monthly investment update for September 2019, we take a look at how the global investment markets, economy and commodities are performing.

An unusual new bank has taken one of the top spots in a list of the biggest lenders.

It’s official. The UK economy has shrunk in size for the first time in seven years.

Latest data from the Office for National Statistics (ONS) shows a major increase in the number of dormant pension pots, making the case for the mooted pensions dashboard even stronger.

The liquidity of investment funds has come into sharp focus in recent weeks, following the trading suspension imposed on investors in the Woodford Equity Income fund.

Latest figures from HMRC show that the average pension withdrawal from pension drawdown schemes in the UK is £7254. This is around 6%-9% of the average pension pot, well above the 4% often touted as a sustainable rate. The upshot is that savers could be at risk of running out of money in retirement.

Interest rates have been at record lows for over 10 years, causing problems for income investors, who have had to take on more risk to get some decent income yields. So what can income investors do to maximise their income potential going forward, without risking too much capital?

In this latest monthly investment update for May 2019, we look at how the investment markets, the global economy and commodity prices are performing.

Brits spend more time planning a holiday than ensuring they have the right pension and financial plans in place.

UK dividends reached a record high in the first quarter, growing to a total of £19.7bn.

As an extension to the Brexit deal looks to be on the cards, we revisit what this means for investors. Should you delay making further investments at this juncture, or even switch to cash, before there is more clarity on the way forward?

Recent research shows that most adults don’t have a will in place and that more than half have no plans to carry out any estate planning to mitigate inheritance tax.

In our latest monthly investment update for March 2019, we look at how the investment markets, the global economy and commodity prices are performing.

Gold is a bit like the Marmite of the investing world; you either love it or you hate it.

When equity market volatility strikes, investors often flee to safety in the form of bonds. Fixed income securities (bonds) are traditionally seen as a less risky asset class than equities, although their value can also go down as well as up.

Last year was not a good one for global stock markets and many experts have been talking of a global recession in 2019 and beyond. But are these fears premature?

As we start the New Year, we take a look at how the investment markets, global economy and commodity prices are performing.

Many children get inundated with gifts at Christmas, often based on the latest fad or craze. However, parents, grandparents and relatives wanting to give a Christmas gift that lasts a bit longer might like to consider investing for their child or grandchild instead - for example through an investment children’s savings scheme or a Junior ISA.

For investors, it’s always a scary time when markets get volatile - particularly when they start to tumble. So what should investors be doing and should they be reviewing their investment portfolios?

As 2018 enters its final month, we have taken a look at how the investment markets, global economy and commodity prices are performing.

Some new research has found that only 39% of Brits who have made a will plan to divide their money equally between beneficiaries.

State pension age equalisation has taken place in the UK. The gradual change now means that women qualify to start getting their state pension from age 65, the same age as men.

Chancellor Philip Hammond has delivered his latest Budget to parliament, the first to take place on a Monday since 1962.

In uncertain times, it is always worth remembering the old adage – that time in the market matters more than timing the market.

If you are confused by the UK’s inheritance tax regime, recent research shows that you are not alone. Yet getting your inheritance tax planning wrong could mean your family is faced with an unexpectedly high inheritance tax (IHT) bill.

As the Brexit deadline of 29 March 2019 approaches, what impact will Brexit have on UK investors?

With the summer holidays drawing to a close, the inevitable round of speculation about pension tax relief changes in the Autumn Budget has begun.

My property is my pension is a phrase we often hear as financial advisers. Does this stack up?

For only the second time in a decade, we have an interest rate rise. This was heavily trailed, and as expected, the rate has been raised from 0.5% to 0.75%. This represents the highest bank rate level since March 2009.

As we bask in this long hot spell, many of us will start dreaming of giving up work and enjoying a sunny retirement, doing the things we’ve always wanted to do. However, some recent surveys suggest that many of us could be in for a bit of a shock.

For quite a while now, there has been talk of a trade war between the US and China. However, it’s now starting to look serious. So as markets have slipped across the world, what will the long-term impact be on investors?

The amount paid in inheritance tax (IHT) reached a record high last year, with over £5.2bn being paid. Yet whilst death and taxes are inevitable, IHT has been called the ‘avoidable tax’ or the ‘voluntary tax’ as with some careful inheritance tax planning there are many ways to avoid it or at least reduce it significantly.

With interest rates being held once more last week, and likely to rise only slowly going forward, the debate about whether income investors should look towards buy-to-let to generate the income they need raises its head again.

The FTSE100 reached a new all-time high of 7778.64 on 12 January this year. In the three months since then, we have seen the index drop at one point by almost 9% to just below 7000, although it has recovered a bit since then, closing last night up a tad at 7328.92.

The new tax year begins today, so the new tax allowances and benefits come into force. This year, most but not all of the changes are good news but here’s a quick guide to what the new tax year has in store for you.

With the FTSE100 dipping below 7,000 for the first time in over a year, and with professional investor sentiment fairly negative about UK equities at the moment, what does the future hold for those investing in the UK?

With the end of the tax year just over a month away, it’s time once again to consider any last minute tax and pension planning, to make sure you utilise the tax breaks available to you. Here’s just a few ideas and options, some of which may be appropriate for you.

The last few days have seen markets fall around the world, prompting some to consider whether this is finally the end of the current long bull run. Sudden sell-offs can cause consternation amongst investors, so what is the best way to deal with a stock market correction?

The start of a new year is always a good time to review your investment goals. To help that process, here are some thoughts on what the experts are saying is in store for 2018.

At the start of 2017, there was talk of a Brexit-inspired economic meltdown in the UK, a market correction and interest rate rises. None of these happened. Why was this – and what can investors expect in 2018?

For investors, the Santa Rally has proved to be a ‘strange but true’ phenomenon over a lengthy period. So will we see one this year, particularly as 2017 has already seen impressive returns across most stock markets?

Yesterday’s budget came and went with no changes to the main tax reliefs and allowances. This is almost unprecedented and represents good news for investors after years of governments tinkering with the rules.

The raising of the Bank Rate to 0.5% last Thursday was the first interest rate rise in over 10 years. So has the tide turned, will interest rates now continue to go up – and if so, what impact will higher rates have on investor’s portfolios?

Over a million people have taken advantage of the pension freedoms introduced in April 2015, which allow over-55s to take their pensions as cash rather than buy an annuity. However, many are missing out because they do not seek financial advice.

Many experts and fund managers are forecasting that Europe could be the place for investors to be over the next few years.

Asset allocation is seen by many as the main driver behind investment performance. So what is it and how does it work?

If investing jargon is all Greek to you, then smart beta may not initially appeal! However, smart beta represents an alternative style of investing, to add to the more familiar active and passive investment styles.

The first half of 2017 saw technology stocks flying on Wall Street. Whilst the passion for all things tech has cooled a bit of late, the world has certainly become a digital and technological marketplace. So as an investor, looking for the next big thing, how can you pick the new Facebook or Google?

A recent research report shows that those who receive financial advice are on average around £40,000 better off than those who do not bother to get advice.

The general election and the ensuing hung parliament, along with Brexit, could have an impact on pensions. A month into the new parliament, what is the current situation regarding pensions and what is the likely impact on investors?

Following last night’s General Election, we now have a hung parliament – as we did back in 2010. The immediate upshot this morning was a fall in sterling of around 2% but at the same time a rise in the FTSE 100 of over 1%, with the index reaching 7545.12, not too far from the current intra-day record of 7,598.99.

Whilst some investors select specific stocks, most investors use collective investment schemes. This makes a lot of sense as it reduces risk for the investor.

Whilst the start of this tax year sees the new main residence nil rate band (MRNRB) come into effect for inheritance tax (IHT) planning purposes, the recent changes to pension rules have affected the IHT planning world in perhaps a more radical way.

When it comes to investing via investment funds, there are two main strategies - active management and passive management.

There are still a few weeks to go for year-end tax planning, so here are a few guidelines to help you make any last minute plans.

The Chancellor announced in yesterday’s budget that the tax-free dividend allowance will fall from £5,000 to £2,000 a year from April 2018. This means investors should look to act now to make the most of their tax allowances.

Whilst there was no change in some areas, the two big talking points of the budget were the reduction in the tax-free dividend allowance and an increase in National Insurance (NI) for the self-employed.

When it comes to investing in funds, looking at past performance data is very alluring and is the starting point for many. Because of this, despite the required disclaimer at the bottom of every piece of investment marketing material, stating that past performance is not a guide to future returns, most investors find it difficult not to rely on it.

Venture Capital Trusts (VCTs) are continuing to sell well this year, with one selling out within 24 hours, according to last Saturday's Times. The total raised by VCTs in 2016 was £169.5m, well up from the £110.8m in 2015.

Friday 13th didn’t prove to be unlucky for the FTSE 100, which reached an all-time high that day, closing at 7,337.81, thus rising for an unequalled 14 consecutive sessions. Since then, the market has fallen back somewhat, leaving investors to ask whether this run can continue or if it has finally run out of steam.

At the start of any New Year, people tend to take stock and make plans for the future – holidays, family matters, house moves, cars. A financial review also makes sense at this time.

Last night, the FTSE 100 closed with a seventh consecutive all-time high, rising 0.2%, or 14.74 points, to close for the first time ever at over 7,200 (7,210.05). This is approaching the longest run of consecutive closing highs, which was recorded in May 1997, when the FTSE 100 finished at all-time peaks for eight straight sessions. It also represents the fifth straight week of gains.

Whether or not we see a Santa Rally this year, both the Dow Jones and the FTSE100 have already been flying high as we approach the year end, despite most expert predictions and the Brexit and Trump votes.

In his first Autumn Statement, Chancellor Philip Hammond praised the "strength and resilience" of the UK economy since the Brexit vote and pointed out that the IMF predicts the UK will be the fastest growing major economy this year, with employment at a record high.

The Dow Jones ended the week at a record high after the shock Trump victory.

The FTSE 100 endured its worst week since January, driven by fears of a Donald Trump victory and the strengthening pound.

Inflation rose to its highest level in 22 months in September. The consumer prices index (CPI) rate of inflation increased to 1.0%, up from 0.6% in August and looks certain to go even higher in the next few months, possibly exceeding the Bank of England’s 2% target next year.

Stock markets in the UK soared yesterday, with the FTSE100 closing at 7,074.34, its highest level since the record finish of 7,104 in April 2015. Indeed, it came close to setting a new record high, before a last-minute burst of profit taking. Meanwhile, the FTSE 250 mid-cap index did close at a new peak.

According to BofA Merrill Lynch, we are in the midst of the second longest cyclical bull market ever. They say the cyclical bull market started on 09 March 2009, and has now comfortably surpassed the June 1949-August 1956 rally, only being beaten by the December 1987-March 2000 advance.

Following Brexit, many investors rushed to get out of UK open-ended property funds, but the fall in prices could present an interesting opportunity for the brave investor.

Consumer confidence has not been dented by Brexit and nor has the stock market.

As widely trailed, UK interest rates were cut today from 0.5% to 0.25% - a record low level and the first cut for over 7 years. The decision to cut interest rates was approved unanimously by the members of the Monetary Policy Committee (MPC) and further cuts were not ruled out.

The cutting of capital gains tax (CGT) in the March budget was an unexpected surprise and is good news for those with larger portfolios held outside Isas and/or those sitting on significant gains.

Amidst all the recent political changes, unexpectedly today the Bank Rate stayed the same – held at 0.5% for a further month at least. The rate has now been held at this level since March 2009.

So Brexit has won the day and the UK has voted to leave the EU. What impact will the result have on investors?

The new pension rules that came into effect just over a year ago mean it could now sometimes make sense to ditch your final salary pension.

Significant tax changes are due in April 2016, so reviewing your financial plans ahead of that could pay dividends.

The budget saw some good news for savers and investors as well as a reduction in capital gains tax, amongst other things.

With the drastic reduction in lifetime allowance, many investors are turning to VCTs to top up their income.

Significant tax changes are due in April 2016, so reviewing your financial plans ahead of that could pay dividends.

The date for the EU Referendum has been set for 23 June. So what impact will it have on the markets?

The pensions revolution of April 2015 means pensions can now play an important role in inheritance tax planning (IHT).

More pension changes are on the way, which is bad news this time, particularly for high earners.

The FTSE100 entered bear market territory on Wednesday, closing over 20% below its previous peak of 7103.98 last April.

The last summer budget saw the Chancellor deliver his promise to increase the Inheritance Tax (IHT) threshold to £1m. However, it is not quite what it seems.

Aaron Pitt, Chartered Financial Planner at Kellands Bristol, takes a look at this perennial issue.

Aaron Pitt, Chartered Financial Planner at Kellands Bristol, takes a look at this perennial issue.

Aaron Pitt, Chartered Financial Planner at Kellands Bristol, takes a look at this perennial issue.

Warren Buffett famously said about successful investing “Be fearful when others are greedy and greedy when others are fearful”.

The Financial Services Compensation Scheme (FSCS) deposit protection limit is being cut by £10,000 to £75,000 in the New Year.

The Federal Reserve Bank (Fed) raised interest rates on Thursday, so will the Bank of England now follow suit?

With all the recent changes in the pension’s world, are you clear about what do with your pension?

The Chancellor, George Osborne, presented his Spending Review and Autumn Statement 2015 on Wednesday 25 November 2015. The Autumn Statement is an annual update of government plans for the economy.

Any interest rate rise has been pushed further into the future once more today.

The latest Markit surveys suggest that the UK economy is still ‘smoking’.

The formal state visit to the UK of Chinese President Xi Jinping this week coincided with official figures showing a fall in China’s GDP.

Rugby supremo Sir Clive Woodward addressed Kellands consultants at our conference last week in Chelsea Harbour.

There is a lot of worrying going on in the financial and investment worlds at the moment. This has led to a good deal of market volatility.

Some pressure is being put on the Government to reverse the new taxes proposed in the 08 July summer budget for buy-to-let investors.

Pensions tax relief is in the spotlight again as a new Green Paper looks at the whole area of incentivising savers to prepare for retirement.

Wednesday saw the FTSE 100 fall to its lowest level since 14 January, closing at 6,388. Yesterday, it fell further to 6367.89, whilst the Dow Jones dropped more than 2%.

Last month’s summer budget had a smattering of good news for the UK’s legion of small and medium sized businesses (SMEs) but the changes to dividend tax could have a big impact on many. The measures introduced could have some significant tax and financial planning implications.

The Bank of England provided bad news for savers, as the prospect of a rise in interest rates receded into the distance once more.

The UK’s recovery is "motoring ahead", according to George Osborne, the Chancellor, as the latest data from the Office for National Statistics (ONS) showed that the UK economy expanded by 0.7% in the three months to the end of June.

Yesterday saw the first fully Conservative budget since the one delivered by Ken Clarke back in 1996.

These are strange times in the investment world, and not just because of the unfolding Greek tragedy before us.

It was pretty inevitable that the tax relief on pensions would be affected in this Parliament, whoever got in.

From the start of this month, firms with fewer than 30 employees will start to be phased into the Government's automatic enrolment scheme, which was set up because people are living longer but are not putting enough money aside for their old age.

The FTSE 100 rose last Friday by 2.32% to 7046.82, as investors welcomed the election result – both the return of the Conservative Party and the fact that it had an overall majority.

Much financial talk over the last year has been around the revolution in pensions, with the liberalisation of the rules to allow much greater pensions choice on retirement.

The Office for National Statistics (ONS) has now stated that the UK economy grew at a faster pace last year than originally announced.

There was a second eclipse late on Friday as the FTSE 100 rose above 7,000 for the first time and hit a new record high. The benchmark stock index closed the day at 7,022.51, having set a new intraday record of 7,024.21 during the afternoon session.

Stocks in the FTSE100 and other UK indices soared yesterday after the Chancellor’s budget speech.

For some time, Labour have said that they would limit tax relief on pensions for "additional rate" taxpayers (those with income over £150,000) if they win the next general election. This plan has now been confirmed and they would use the savings to pay for a reduction in university tuition fees from £9,000 to £6,000.

After threatening to do so a few times over the past year, the FTSE100 finally reached a new all-time high on Tuesday afternoon, passing the previous recorded at the end of the last millennium, just before the dotcom bubble burst.

The rate of UK Consumer Prices Index (CPI) inflation fell to 0.3% in January, according to figures from the Office for National Statistics (ONS) yesterday.

This year, so far, the stock markets have held up fairly well, despite all the noise out there in the marketplace, with the FTSE100 running at around 3% above its end of 2014 closing figures.

The much anticipated event finally happened in January. Mario Draghi of the European Central Bank (ECB) finally announced the introduction of quantitative easing (QE) in Europe with immediate effect. The figures are big - the ECB will buy back €1.1 trillion in assets, including government bonds and EU institutions, at a rate of €60bn per month.

December 2014 saw UK consumer price inflation fall sharply to 0.5%, down from the 1% recorded in November, according to the Office for National Statistics (ONS). Many economists were expecting a rate of around 0.7%.

Figures out today showed the Eurozone has officially slipped into deflation, with prices declining 0.2% in December compared with the same month a year earlier.

As we enter 2015, it’s time to look back on the year gone by and start to plan for the year ahead.

Following the Budget last March that introduced significant changes to savings and pensions, the final Autumn Statement before the General Election next year saw the Chancellor George Osborne overhaul the stamp duty system. The changes come into effect immediately and will, it is claimed, improve things for 98% of house buyers.

Whilst some of the key issues of long-term care have been addressed by the government in its Care Act, several problems remain.

Last month, radical changes to the intestacy rules were introduced, representing the biggest change to the intestacy laws since they were introduced in 1925.

The UK economy grew by 0.7% in the three months to September, according to the latest figures from the Office for National Statistics (ONS).

On Tuesday last week, the chancellor George Osborne put forward the Taxation of Pensions Bill, which gave further details of the revolutionary pension reforms first announced in the Budget back in March. Amongst the proposals, the chancellor announced that people will be able to use their pension pots “like bank accounts”, withdrawing money whenever they choose.

Yesterday Scotland voted no to independence by a 10.6% margin, higher than predicted by any of the various polls. The final result saw 55.3% voting ‘no’ and 44.7% ‘yes’.

Despite the UK economy doing well, the stock market has seen further falls this week, since the peaks reached in September. Revised figures from the Office for National Statistics (ONS) show that the economy grew slightly faster than first thought in the second quarter of 2014, up 0.9% rather than 0.8%. The ONS figures also show that the UK economy overtook its pre-recession peak earlier than thought, surpassing it in the third quarter of 2013 rather than the second quarter of 2014 as previously stated.

Earlier this year, the government announced momentous changes to the pension rules. And now there is more good news, with major changes being introduced to the tax treatment of pensions on death.

At a time when talk in the UK is of when interest rates will rise, the European Central Bank (ECB) caught markets on the hop with cuts to its three main interest rates. The headline rate was lowered to 0.05% and the deposit rate to -0.2%. The Bank of England meanwhile left rates unchanged again this month.

According to FE Analytics, one of the leading providers of investment data, Asia Pacific, excluding Japan, is the leading performer out of all the investment sectors this year, rising 10.1%. The global emerging markets sector has risen 7.8%. By way of contrast, the FTSE All-Share Index has been more or less flat over the year.

On Friday, it was reported that the UK economy grew by 3.2% in the second quarter compared with the same period last year. This is slightly higher than the original estimate of 3.1% and means the economy is growing at its fastest pace since 2007.

Just when it seemed pundits had started talking again about the continuation of the current long bull run, geopolitical risk has re-emerged as an investment issue.

The radical pensions changes, announced back in the March budget by Chancellor George Osborne, were given approval on 21 July 2014. The main thrust of the proposals have been adopted in full and a few other areas have been clarified somewhat.

The latest GPD figures out today show that the UK economy has grown again – and has now expanded to be worth more than its peak in 2008.

Last week, the Bank of England held UK interest rates at 0.5% for another month. Interest rates have been at this record low level since March 2009.

There were some interesting statistics in the Daily Telegraph recently, which amongst other things, pointed out that eight out of ten of the 23 million Isa investors choose cash accounts rather than opting for stocks and shares Isas.

With effect from today, the new Isa rules come into play. The result is a transformation in the way Isa schemes work, providing much more flexibility along with significantly larger tax-free allowances.

With the World Cup just under a week away, Goldman Sachs has produced a detailed report on the World Cup and its economic impact.

‘Sell in May and go away. Come back on St Leger’s Day’. So goes the old adage and it is obviously one to ponder as we enter the month of June.

There has been a lot of good news recently on the financial and economic fronts. Business confidence in the UK is rising and the markets have been performing well. Elsewhere, industrial output figures suggest that the Eurozone is recovering, whilst the US Dow Jones index ended the month of April at a record level. Even the Spanish economy grew – and at its fastest rate since 2008. So it would seem that we are in a glass half full phase.

"Securing the recovery is like making it through the qualifying rounds of the World Cup - it's a real achievement, but not the end goal. The prize in the economy is sustained and prolonged growth."

The UK economy grew by 0.8% in the first quarter of 2014. This follows on from the growth of 0.7% in the final quarter of 2013, according to the latest figures from the Office for National Statistics (ONS).

The UK inflation rate has fallen from 2.8% a year ago to 1.6% in March 2014, according to the Office for National Statistics (ONS). It is now at its lowest rate since October 2009.

According to the latest World Economic Outlook forecast from the International Monetary Fund (IMF), the UK looks set to be the fastest growing major economy this year. Inflation has stabilised, unemployment is down, and consumer confidence is up, keeping the UK on track to post its strongest growth since 2007.

The budget saw some dramatic headline changes on the pension’s front, but some of these changes don’t come into play until next April 2015, partly to give pension providers time to adjust their systems and practices.

In his penultimate budget before next year’s general election, the Chancellor announced some fairly radical changes to pensions and savings.

A couple of new forecasts have just come out suggesting that by the summer of 2014, the UK economy will overtake the peak level it reached before the 2008 crisis.

A couple of recent surveys by Scottish Widows are quite revealing about the nation’s psyche as well as behaviour when it comes to financial matters in general – and retirement in particular.

Announcing on Wednesday what he called “phase two” of forward guidance, Mark Carney, the governor of the Bank of England, stated that interest rates are unlikely to rise before 2015, as the Bank believes the economy is not yet strong enough to support an increase.

Mortgage rates have started to rise again, with five-year fixed rate mortgages moving up from their record lows. This is partly down to the improving economy, plus expectations that interest rates will now rise sooner rather than later.

If you are building up a generous company pension scheme, imminent changes to the taxation of pension savings could seriously cost you, unless you act quickly.

The UK economy grew by 0.7% in the fourth quarter of 2013, bringing the annual growth rate to 1.9%, according to the Office for National Statistics (ONS). The ONS said that this was the UK's fastest annual rate of growth since 2007.

It has been a good start to the year for the UK in economic terms. The latest figures and reports show that not only is inflation coming down but unemployment is also down, whilst IMF predictions suggest that the economy is certainly on the up.

At the start of the noughties, some investors built their portfolios with BRICs – investing in the then emerging markets of Brazil, Russia, India and China. The past decade has worked out fairly well for them. However, several commentators believe that the BRIC markets are beginning to overheat and some investors are starting to look for new emerging market investment opportunities.

In a recent interview with the Daily Telegraph, Steve Webb, the pensions minister, spelled out his vision for an overhaul of how pensions work. The essence of his plan is that he wants pensioners to be able to switch to better annuities regularly in the same way that homeowners can change their mortgage deals every few years. The aim is to avoid the situation where pensioners are trapped in potentially poor-value schemes until they die.

The Consumer Prices Index eased to 2% in December, down from 2.1% the month before. This is the first time that inflation has hit the government target of 2% since November 2009.

As one year closes and another begins, it is instructive for investors to look back on 2013 and see how the markets performed.

27/4/2024

John Barnett had been giving a formal legal deposition against the plane manufacturer before his sudden death.

April 15, 2024

Five options to consider to help boost your potential retirement income.

Read more